Big Shot Foreclosure Mill Lawyer Goes Full Blown Jerry Springer

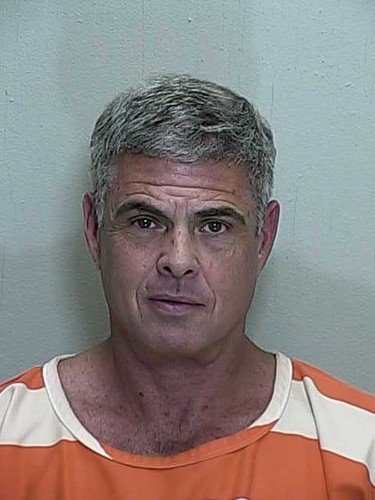

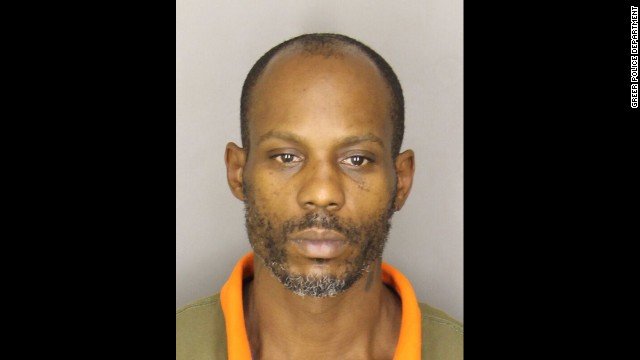

Big Shot Foreclosure Mill Lawyer Goes Full Blown Jerry Springer After Judge Rules Against Him A big shot foreclosure mill lawyer attacked the opposing attorney Bruce Richardson. The scuffle happened as the two were leaving the courtroom. David Dunn, a partner at Hogan Lovells became so enraged when a Brooklyn judge ruled against his client, Bank […]

Big Shot Foreclosure Mill Lawyer Goes Full Blown Jerry Springer Read Post »