New York Non-Profit Westchester Residential Opportunities Busted Poaching Clients From Attorneys

White Plains-based housing non-profit Westchester Residential Opportunities is in hot water. WRO is being accused of illegally poaching clients by multiple lawyers.

New York foreclosure defense lawyers state their clients have been receiving letters and emails from WRO‘s Mortgage Default Director Veronica Raphael.

A copy of the email was forwarded to MFI-Miami. Raphael’s letters encourage people to fire their attorneys and retain Westchester Residential Opportunities.

The emails and letters also imply the homeowner’s lawyer is ripping off the homeowner. She also makes the fraudulent claim that a loan modification application STOPS a foreclosure in New York. It does not.

She also implies you don’t need to be a lawyer to practice law. You can represent yourself but nothing pisses off a judge more than a Know-It-All pro se litigant rambling on about Rothschild Family or Illuminati conspiracy theories.

It appears Veronica Raphael is preying on the legal ignorance of people in Westchester County. In other words, she is doing exactly what Wells Fargo was busted for in the Baltimore Ghetto Loans scam.

Several lawyers claim to have filed complaints with HUD. They have also filed grievances with the New York State Grievance Commission for the 9th District in White Plains. The complaints allege Westchester Residential Opportunities Board authorized the campaign. Lawyers on the board like Margaret M. (Gretchen) Flint and Alan R. Wolfert should know better.

Flint is also a law professor at Pace University and Wolfert has been a lawyer since 1966. Both should know that this kind of behavior is unethical.

What Are CRA Housing Agencies Like Westchester Residential Opportunities?

The United States Congress passed The Community Redevelopment Act in 1977. The goal was to encourage banks to help people in low and moderate income neighborhoods to become homeowners.

Banks can offer low-interest mortgages to people because the local municipality is donating the land or leasing the land to the homeowner.

They also like offering loans through CRA housing agencies because it shows they active in the community.

Banks even contribute and help fund non-profit housing agencies under the CRA. This, in turn, helps the banks when they seek FDIC approval to expand their business. It also helps if the bank needs FDIC approval to merge with another bank or expand their branch network. This is one of the reasons banks flock to CRA projects and fight over eligible homeowners.

This business model may have worked in the 1970s or the 1980s. However, the housing boom of the late 1990s and early 2000s shot this model out the window. Minority homeowners flocked to sub-prime loans or government-backed loans during the housing boom.

The relationship between the banks, CRA housing agencies, and urban politicians became more symbiotic. CRA housing agencies becoming less dependent on federal and state grants and more on corporate giving from lenders.

CRA housing agencies set up under the Community Reinvestment Act are a joke. They need to relegated to the same place where subsidies for cotton gin and buggy whip manufacturers now rest.

CRA Non-Profits Like Westchester Residential Opportunities Lead Homeowners Into Financial Gas Chambers

CRA housing agencies began offering modifications and foreclosure assistance at no cost 10 years ago. Many of them claimed they had inside relationships with the banks who were also their benefactors. They claimed and still claim they could save the homeowner from being homeless thanks to this cozy relationship.

Banks did a media blitz telling people to work with CRA housing agencies like Westchester Residential Opportunities or come directly to them. The last thing banks wanted was a homeowner to talk to someone like me or to speak with a qualified consumer lawyer.

Banks want to control the homeowner and aren’t afraid to use CRAs like Westchester Residential Opportunities as their patsies.

I come from the world of lending. I also have a track record of helping attorneys kick the crap out of lenders. MFI-Miami prides itself on making CEOs use Alka-Seltzer as a chaser after popping a couple of Rolaids. So, naturally, CRAs like Westchester Residential Opportunities run from me as if I have the plague.

Federal and state politicians wholeheartedly jump on board the propaganda coming from the banks and encourage constituents to call their local CRA housing agency.

Politicians even tell voters not to pay for foreclosure defense because a CRA housing agency like Westchester Residential Opportunities could help them for free.

Politicians want to score points with voters by giving them something for free so they tell them to call a CRA. CRA housing agencies were and still are herding homeowners into a financial version of the Nazi Death Camp.

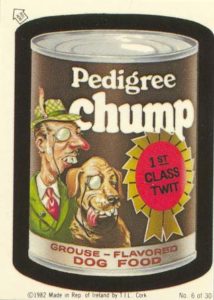

CRA Housing Agencies Like Westchester Residential Opportunities Are Chumps For The Banking Industry

CRAs like Westchester Residential Opportunities like to play on their non-profit status. They think it gives people that warm and fuzzy feeling. Yet homeowners fail to understand the complex relationship between CRA housing agencies and the banks.

CRA housing agencies like Westchester Residential Opportunities aren’t looking out for the best interest of the homeowner fighting a foreclosure. The CRA Housing Agency is covering their ass. They want to protect their funding that comes from their banking benefactors. They could be like NACA in Boston which is essentially a for-profit enterprise disguised as a non-profit.

Lenders aren’t afraid to use their status as a benefactor to get what they want. Lenders want to take possession of the homeowner’s property.

Homeowners tend to be in a worse position than they were when they started the process with a CRA Housing Agency like Westchester Residential Opportunities

The homeowner eventually gets fed up with the CRA comes to MFI-Miami with their file. We are in shock by the fact that the CRA housing agency like Westchester Residential Opportunities didn’t appear to have someone on the inside as they claimed.

The CRA housing counselors talk to the same customer service people as the homeowner.

Housing counselors also have absolutely no knowledge of the basic mechanics of mortgage lending. They are also naive enough to believe everything the lender tells them.

The banks teach CRA housing counselors just enough so they can convince homeowners to get in the system. CRAs get the homeowner trapped in the Kafkaesque maze of bank’s system. This is what the bank wants because now they have total control over the housing destiny of the homeowner.

Also, see:

NACA And CRA Housing Agencies Screwed Homeowners With Loan Modifications

Its Time To Say Sayonara To Federally Funded CRA Housing Agencies