Should Sterling National Bank Be Re-Named “Soprano” National Bank?

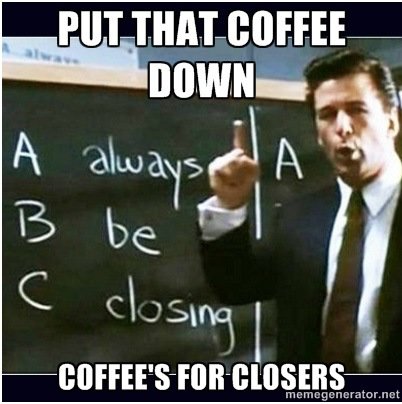

Intimidation, Liquidation Of Accounts, Mob Style Collection Tactics Are The Everyday Practices Of Sterling National Bank People want to think small town banks like Sterling National Bank are run by a sympathetic George Bailey types. Small community banks operate like the mafia. They have no problem using intimidation and thuggery to get what they want. […]

Should Sterling National Bank Be Re-Named “Soprano” National Bank? Read Post »