Select Portfolio Servicing Warning! Can Select Portfolio Validate Your Mortgage Debt? Probably Not!

Steve Dibert, CEO of internationally-renowned mortgage fraud investigation firm MFI-Miami, announced today that MFI-Miami has discovered serious flaws in the way Credit Suisse subsidiary Select Portfolio Servicing validates debt owed by homeowners. As a result, MFI-Miami has issued a Select Portfolio Servicing Warning to homeowners.

Steve Dibert, CEO of internationally-renowned mortgage fraud investigation firm MFI-Miami, announced today that MFI-Miami has discovered serious flaws in the way Credit Suisse subsidiary Select Portfolio Servicing validates debt owed by homeowners. As a result, MFI-Miami has issued a Select Portfolio Servicing Warning to homeowners.

MFI-Miami CEO Steve Dibert:

Homeowners need to request their complete mortgage transaction histories from Select Portfolio Servicing and review them. If there is missing information or if something doesn’t look right, they need to contact a lawyer or a properly trained mortgage fraud expert immediately!

MFI-Miami has examined nearly 200 transaction histories from mortgage loans currently serviced by Credit Suisse subsidiary Select Portfolio Servicing since 2016. Nearly 175 of these contained serious accounting flaws in the transaction histories. These flaws would call into question the amount homeowners owe on their mortgages. Additionally, MFI-Miami’s team of Forensic CPAs have described SPS transaction histories as everything from a mess to a trainwreck.

These flaws include 5-year and 10-year gaps in the transaction histories. They also include conflicting payoff figures on payoffs dated the same day. As well as transaction histories with fictitious and inflated payments made to local taxing authorities.

Steve Dibert also said:

There is a definite pattern of impropriety going on here. I find it odd that one of the largest mortgage servicers in the US and one owned by Swiss bankers can’t do the basic 5th-grade math required to calculate an accurate payoff on a mortgage. It’s either gross incompetence or it’s set up by design.

Select Portfolio Servicing Warning! This Isn’t the First Time SPS Has Been Exposed For Having Servicing Issues

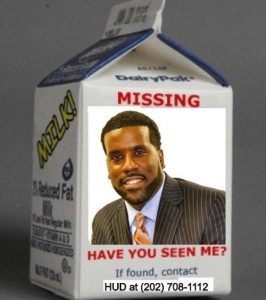

In November 2003, Select Portfolio Servicing then known as Fairbanks Capital agreed to pay $40 million to settle with the FTC and the U.S. Department of Housing and Urban Development. Both agencies claimed the company was engaging in unfair, deceptive, and illegal practices in the servicing of subprime mortgage loans.

Fairbanks Capital settled with the FTC and HUD for $40 million as redress to affected consumers. The settlement also imposed specific limitations on Fairbanks’s ability to charge fees and engage in certain practices when servicing mortgage loans. In June 2004, Fairbanks changed its name to Select Portfolio Servicing, Inc. and SPS Holding Corp.

Also, check out this article:

Select Portfolio Servicing Caves! Walks Away From Foreclosure Battle.

Janet Allen 10:52:07 am October 9, 2019

Hi, chase Bank sold my mortgage to select portfolio servicing without my permission can i sue chase Bank