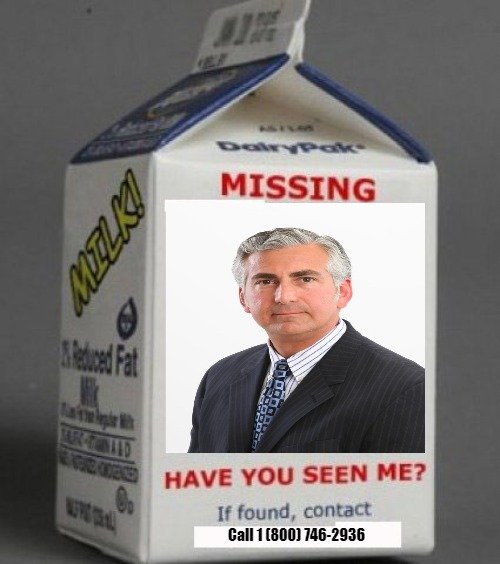

Ocwen CEO Glen Messina Is Missing In Action. Sources Say No One Has Seen Him At Ocwen HQ In Nearly A Month

The cool thing about owning a company like MFI-Miami means people like to give us the dirt on their bosses.

MFI-Miami has learned disturbing news from our sources from Ocwen. Our sources at Ocwen say Ocwen CEO Glen Messina hasn’t been seen at the West Palm Beach office in nearly a month.

So, where in the world is Glen Messina? No one knows. Ocwen CEO Glen Messina appears to be missing.

Ocwen CEO Glen Messina was hired by the Ocwen Board of Directors in April 2018 to replace longtime Ocwen executive Ron Faris. Faris is credited with saving Ocwen after the company’s board of directors ousted Ocwen Founder William Erbey in 2014.

Federal and state regulators descended on Ocwen like a horde of Vikings after the financial crisis. However, instead of armies armed with axes and swords, they came armed with subpoenas and investigators. As a result, Ocwen’s stock plummetted. NYSE almost de-listed the company. The company almost went bankrupt during the last two years of Erbey’s reign.

Ocwen also became mismanaged during this time. The situation was so bad Ocwen’s own attorneys couldn’t reach decision makers. Homeowners complained they were stuck on hold with Manoj in India for hours.

Ocwen’s board promoted Ron Faris to CEO and COO in 2014 after kicking Erbey to the curb. He saved Ocwen. Ocwen also became responsive to their customers and began working deals to let them stay in their home.

Is Ocwen CEO Glen Messina Really Missing Or Just Driving Ocwen Over A Cliff As He Did With PHH Mortgage?

In a previous life, Ocwen CEO Glen Messina was CEO of PHH Mortgage from 2012 through March 2017. Anyone who worked in mortgage servicing during Messina’s tenure remembers it more as rein of terror. Mortgage customers complained of endless hold times and general incompetence with PHH’s customer service department.

Banks like HSBC and Bank of America began pulling massive mortgage servicing contracts from the company. The CFPB slapped PHH Mortgage with $109 million fine over RESPA violations. Unlike Ocwen’s Ron Faris who sat down with regulators negotiated a settlement and agreed to address the problems, PHH Mortgage under Messina spent hundreds of millions of dollars fighting the CFPB. The fight nearly bankrupted PHH Mortgage.

Infighting by top executives also marred Messina’s leadership at PHH Mortgage. Things became so bad even Messina packed his bags and left the mess he created.

Ocwen’s board hired Messina immediately after the acquisition of PHH Mortgage. Messina immediately created a Byzantine corporate bureaucracy by renaming and reorganizing Ocwen’s mortgage servicing. He named Ocwen’s mortgage servicing after his former company and changed homeowner’s account numbers. He also outsourced most customer servicer functions to call centers in India. Customers find their calls getting disconnected after waiting on hold for nearly 60-90 minutes. Ocwen’s own foreclosure lawyers complain they can’t reach Ocwen executives for decisions.

Things are so bad at Ocwen that customers have to trek to Ocwen headquarters at 1661 Worthington Road in West Palm Beach to talk to a customer service associate.

So is Ocwen CEO Glen Messina AWOL or just a bad leader?