New York City Mayor de Blasio Has Discovered A Cure For The Zombie Homes Plague In NYC! It’s lawsuits!

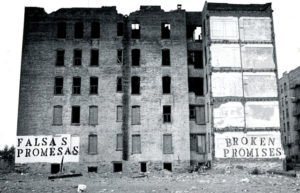

New York State has been plagued by zombie homes in the decade since the financial crisis. Zombie homes are abandoned foreclosed homes that are owned by banks and lenders. In 2016 New York State passed a law allowing the state and municipalities to fine lenders for not maintaining the property. NYDFS also has the ability to slap a $500 per day fine on the lender for each property.

New York State has been plagued by zombie homes in the decade since the financial crisis. Zombie homes are abandoned foreclosed homes that are owned by banks and lenders. In 2016 New York State passed a law allowing the state and municipalities to fine lenders for not maintaining the property. NYDFS also has the ability to slap a $500 per day fine on the lender for each property.

As a result of the law, NYDFS successfully sued PHH last year for $119,000 for a single property in the Hudson Valley.

The city’s Department of Housing Preservation and Development is using the law to sue Citimortgage and Wells Fargo. They are also suing three mortgage servers that represent the two lenders. The largest one being Ocwen.

New York’s zombie homes law designates both lenders and their mortgage servicers as responsible parties for the safety and security of properties in foreclosure.

The HPD alleges the companies failed to clean up a cluster of abandoned homes in Brooklyn.

HPD Deputy Commissioner Leila Bozorg told WNBC:

Our goal is to get these banks to take accountability for these properties.

One of the zombie homes named in the suit had waist-high weeds sprouting from garbage on the front porch. A condom and a crushed malt liquor can lay on the front steps.

The HPD lawsuit states CitiMortgage and its servicing company should have cleaned the property up at 1889 Bergen Street up months ago.

Geoffrey James lives next door told WNBC:

A spokesman for Citi declined to comment on the blighted property.

Wells Fargo And Ocwen Allow Drug Addicts And Prostitutes To Hang Out In Zombie Homes

It seems like lenders like Wells Fargo and Ocwen like having drug addicts and prostitutes squatting in their urban zombie homes. They have had a decade to deal with the problem. Yet, have done nothing but enjoyed their idyllic life in the lily white suburbs of Orlando and Des Moines.

It seems like lenders like Wells Fargo and Ocwen like having drug addicts and prostitutes squatting in their urban zombie homes. They have had a decade to deal with the problem. Yet, have done nothing but enjoyed their idyllic life in the lily white suburbs of Orlando and Des Moines.

The city also claims Wells Fargo failed to secure at 1831 Park Place. Another lawsuit also alleges Ocwen as mortgage servicer for Wells Fargo neglected 31 Essex Street in Brooklyn.

Marco Lopez, a 31-year-old who lives next door to that dilapidated house, says it has been notorious for squatters and drug activity:

Wells Fargo denied having an ownership interest. This is due to the convoluted securitization system where no one knows who owns what.

Kevin Friedlander, a spokesman for Wells Fargo stated Wells Fargo “does not have ownership” of 31 Essex Street. He pointed the finger at Ocwen. Ocwen is the loan servicer assigned to the property.

New York City is demanding lenders and their servicing companies pay more than $1 million in fines and reimbursements for repairs the city has already made to try and keep the zombie homes safe.

The state’s zombie home law also calls for up to a $500 penalty for each day an abandoned foreclosure fails to meet safety and environmental health standards.

The city also expects to file more zombie home lawsuits against lenders and their subcontractors in the months to come.

Write A Comment