Financial Necrophiliac SLS Is Still Trying To Illegally Collect On Decades Old Zombie Debt From Homeowners.

Financial necromancer SLS is still at it.

They are still trying to collect on decades old zombie second mortgage debt from homeowners.

Most of the homeowners that Specialized Loan Servicing are illegally harassing had their second mortgages wiped out in bankruptcy over a decade ago.

However, that hasn’t stopped SLS. SLS relentlessly pursues these people for money with the tenacity of a fat guy at an All-You-Can-Eat Chinese Buffet.

SLS hires armies of bottom-feeding lawyers hurting for an easy pay check to harass homeowners to pay a debt that no longer exists.

How All This Started

About six or seven years ago, bean counters at Bank of America figured out a way to skirt the National Mortgage settlement. They figured out how to make a few bucks at the same time. They decided to sell their worthless 2nd mortgages to any sap servicer and investor.

BofA and other banks loaded up bankers’ boxes full of these garbage loans. They put them in storage units around Dallas, TX and Charlotte, NC.

Then, like a scene out of Storage Wars, second-tier and third-tier servicers like SLS and others would bid on the hundreds of bankers’ boxes in the storage unit.

Most of these loans were charged off over a decade ago. Therefore, they are nothing more than worthless paper and the top-tier banks knew it. So, servicers and investors like SLS ended up like a contestant on a game show who the picks the empty mystery box.

The Shakedown Of Homeowners By Financial Necrophiliac SLS Is Nothing More Than Harassment

Specialized Loan Servicing faces a number of hurdles they have to overcome in trying to enforce these zombie mortgages.

Specialized Loan Servicing faces a number of hurdles they have to overcome in trying to enforce these zombie mortgages.

The first being lack of standing. The vast majority of the time, SLS cannot prove they have legal standing to foreclose. But, Why?

Most of the time, they lack the original wet-ink copy of the note. This is a requirement in most judicial foreclosure states. SLS also needs to be able to validate the dollar amount of the debt. However, in 99.9% of their zombie loans, they can’t.

Many of these loans are also past the 6-year statute of limitations. Like with most zombie debt, a lender will pop out of the blue usually 7-10 years later to try to collect on the debt.

However, most states like Florida have a 6-year statute of limitations. The statute of limitations bars lenders from coming after you after 6 years. However, check with a lawyer because the statute of limitation laws may vary from state to state.

SLS knows all this. Yet, it doesn’t seem to stop them from trying to shake down and threaten homeowners.

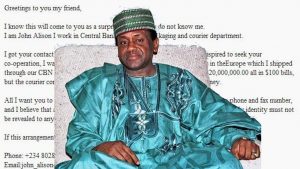

Financial Necrophiliac SLS Is Playing The Nigerian Prince Email Numbers Game

SLS also knows they will not be able to collect on these zombie loans. However, they look at this as a numbers game.

SLS also knows they will not be able to collect on these zombie loans. However, they look at this as a numbers game.

They use the same methodology as Nigerian email scammers. If SLS spends $10,000 harassing 50,000 people eventually 50-100 people will get fed up and give them money. As result, SLS could potentially reap a 500% ROI.

The only problem for the homeowner is if they succumb to the pressure of SLS and give them money. As a result, the homeowner could harm themselves in long run by doing this.

If a homeowner gives SLS money, the mortgage is now technically re-instated. This would allow SLS to refuse future payments and initiate foreclosure.

Is Financial Necromancer SLS Harassing You Over Decades Old Zombie Debt? Call 888.737.6344 or Contact MFI-Miami Today!

Also, Read More About SLS Shaking Down Homeowners:

SLS Scam Alert: SLS Busted Shaking Down New Yorkers

Mortgage Servicer SLS Goes All Lord Humungus On MFI-Miami

Australian-Owned Specialized Loan Servicing Says, “Eff You, USA!”

Specialized Loan Servicing Warning! Can SLS Validate Your Debt?

Does Specialized Loan Servicing Discriminate Against People of Color?

MFI-Miami Forces Specialized Loan Servicing Into $1.8M Settlement