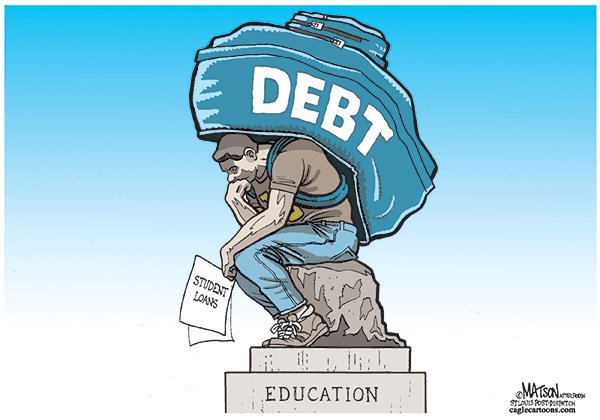

Fraudulent Student Loan Debt Relief Companies Are Preying On The Most Vulnerable Student Borrowers

A NerdWallet investigation has found fraudulent student loan debt relief companies are preying on the most vulnerable with student loans. Federal agencies dispute who’s to blame and what to do.

A NerdWallet investigation has found fraudulent student loan debt relief companies are preying on the most vulnerable with student loans. Federal agencies dispute who’s to blame and what to do.

The CFPB and the Federal Trade Commission have closed only seven companies that have scammed consumers. The scam outfits make rosy promises to borrowers promising reduced and forgiven student loan debt.

NerdWallet discovered more than 130 student loan debt relief businesses with records of questionable or illegal behavior. State and federal documents nationwide identified companies hit by lawsuits and court actions or negative. Some of these bogus student loan debt relief companies also had owners who couldn’t manage their own debts.

NerdWallet found many of the businesses are also still fleecing borrowers. Some charge illegal upfront fees and monthly dues for debt consolidation. Scammers hijack debtors’ accounts and let payments lapse. This leads to the borrower leads to garnished wages and seized tax refunds. Borrowers have also had their credit ruined.

CFPB officials defend their scant enforcement record and consumer advocates largely agree with them. They say that playing Whac-A-Mole with debt-relief scammers is a costly, fruitless game.

Consumer groups also say that playing Whac-A-Mole with debt-relief scammers is a costly and fruitless game.

State prosecutors are trying to fill the void. State agencies have closed nearly three dozen companies in individual states. Yet, many of those remain free to operate.

The CFPB and advocates fault the US Department of Education. They claim the DOE is enabling the root cause of the scams. They point to the bad practices of loan-servicing companies such as Navient. Advocates claim loan servicers are failing to help debtors struggling to make their payments. Thus driving them into the arms of dishonest companies.

NerdWallet has a watch list that you can see here.