JPMorgan Client With Dementia Sues Bank For Stealing $50Million

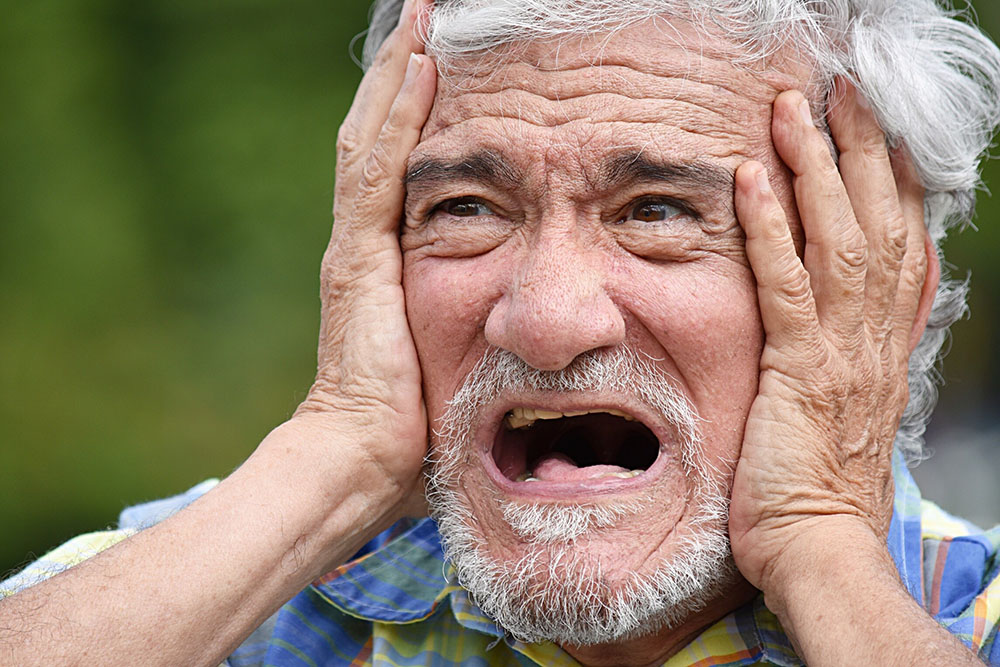

JPMorgan Client With Dementia Sues The Bank For Stealing $50 Million From Him And Making Him Move In With Relatives A JPMorgan client with dementia has sued America’s biggest bank. The elderly client has accused the bank of pushing high risk investments despite his obvious signs of dementia. As a result, the dementia client is […]

JPMorgan Client With Dementia Sues Bank For Stealing $50Million Read Post »