FHA Did Not Approve 40-Year Loans For New Home Buyers

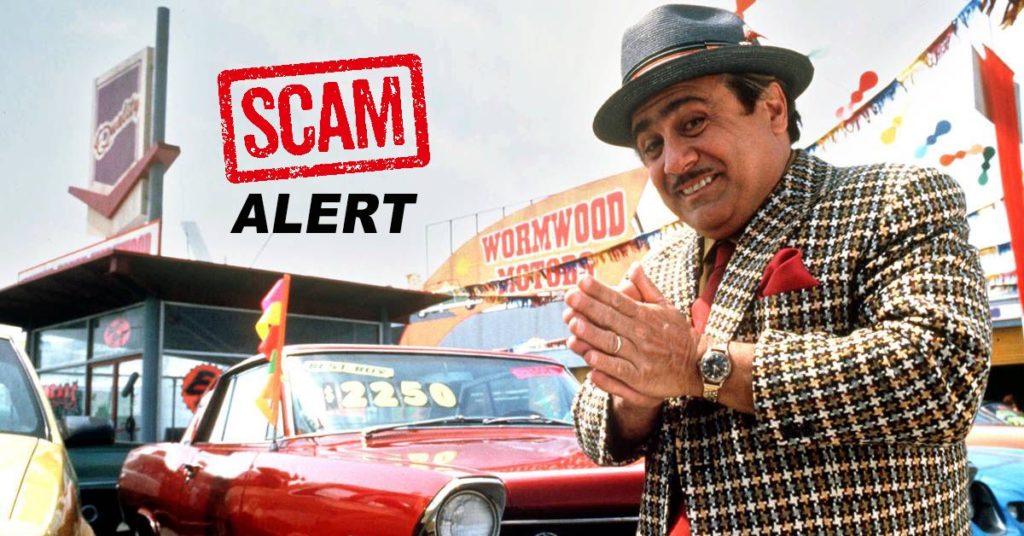

FHA Did Not Approve 40-Year Loans For New Home Buyers. The New Rule Only Applies To Modifications Of Existing Loans Greedy mortgage brokers are spreading misinformation on TikTok. This time its about recent a FHA announcement. The FHA announcement regards the increase the mortgage modification term to 40 years. Tik Tok creators are posting videos […]

FHA Did Not Approve 40-Year Loans For New Home Buyers Read Post »