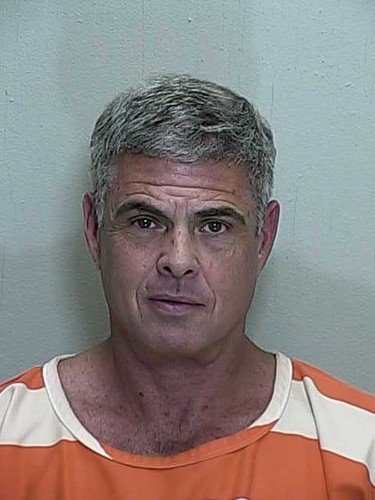

Lee Farkas Says Prison Is Depressing And He Is So Lonely That He Feels Like A Zombie

If you didn’t work in wholesale lending during the housing boom, you have probably never heard of Lee Farkas or his now defunct and disgraced company, Taylor, Bean and Whittaker who were a major player in wholesale lending.

Lee Farkas, dead broke and with no training in mortgages or finance, bought a small mortgage company called Taylor, Bean & Whitaker with $75,000 that he had borrowed from a friend in 1991. By 2001, TBW became one of the nation’s top mortgage lenders during the housing boom. Lee Farkas recruited help from mortgage brokers throughout the U.S. and was processing more than 6,000 mortgages a year.

Intoxicated by greed, Farkas began manufactured phony mortgages while running his company into the ground. According to the Wall Street Journal, He misappropriated nearly $38.5 million to finance a lavish lifestyle with several homes, vintage cars, and a private jet.

Catherine Kissick, the senior Vice-President of the now failed Colonial Bank was Farkas’ partner in crime and helped him sweep massive funds into TBW’s accounts to cover up staggering accumulated deficit and helped Farkas sell loans multiple times to hedge funds and other financial institutions.

Lee Farkas and six co-conspirators were responsible for one of the biggest fraud schemes to emerge from the housing boom.

Lee Farkas Doesn’t Like Prison.

After being convicted in 2009, Farkas was sent to FCI Butner Medium II in north Carolina. The same medium-security prison as Ponzi schemer, Bernie Madoff.

Farkas told the Wall Street Journal, he gets “depressed a lot of days” and“that he has lost 43 pounds and “most” of his friends since his arrest.“

Farkas also added, “You’re not really alive in here, you’re a zombie—just a body walking around, eating, sleeping and being yelled at.”