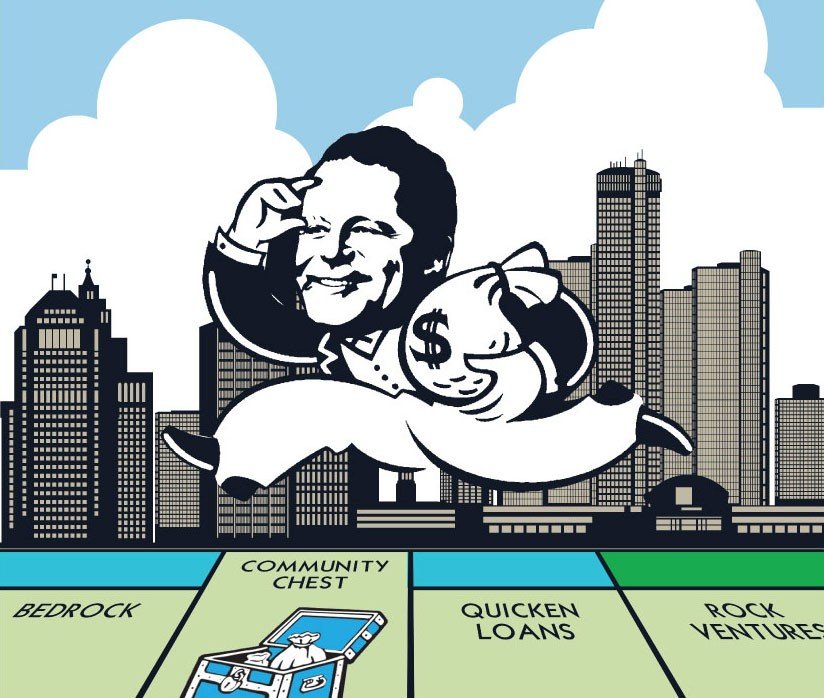

AIME Accuses Quicken Loans And Other Major Retail Lenders Of Scamming Veterans On VA Loans

The mortgage trade group AIME is claiming that Quicken Loans and other lenders are taking advantage of VA borrowers. Association of Independent Mortgage Experts CEO Anthony Casa alleges lenders are overcharging them for their mortgages. and overcharging them for their mortgages.

The mortgage trade group AIME is claiming that Quicken Loans and other lenders are taking advantage of VA borrowers. Association of Independent Mortgage Experts CEO Anthony Casa alleges lenders are overcharging them for their mortgages. and overcharging them for their mortgages.

HUD, Ginnie Mae, and the VA are investigating lenders. The government is investigating the lenders for targeting service members and veterans for quick and potentially risky refinance deals.

The investigation has led to some lenders being booted from Ginnie Mae’s primary mortgage securities platforms. In addition, some lenders are also being restricted for questionable conduct.

Casa accuses lenders of charging veterans as much as 20% higher for a mortgage in a lengthy post on LinkedIn

The AIME CEO also names the culprits. Casa accuses Quicken Loans, Movement Mortgage, loanDepot, and Fairway Independent Mortgage all charge much higher interest rates to veterans.

Casa states in his post:

Lenders Try to Throw Their Weight Around With AIME

Fairway did not take the allegations lightly. Fairway’s general counsel sent Casa a cease and desist letter. Fairway’s lawyers ordered Casa to remove the information from both his LinkedIn and Facebook pages. The letter calls Casa’s post defamatory.

In return, Casa published the cease and desist letter on that same LinkedIn post. He also added his response to the letter.

Casa and AIME claim that his data is 100% true. He even begs the company to escalate the issue further.

Fairway did not respond to Casa. The company did respond to HousingWire’s request for comment on the matter with a lengthy statement that lays out its case against Casa.

Fairway General Counsel Elizabeth Steinhaus said in a statement:

Steinhaus also contends that Casa is not being entirely truthful with the data he uses in his posts:

Casa writes that he has no plans of backing down:

Also, Read: