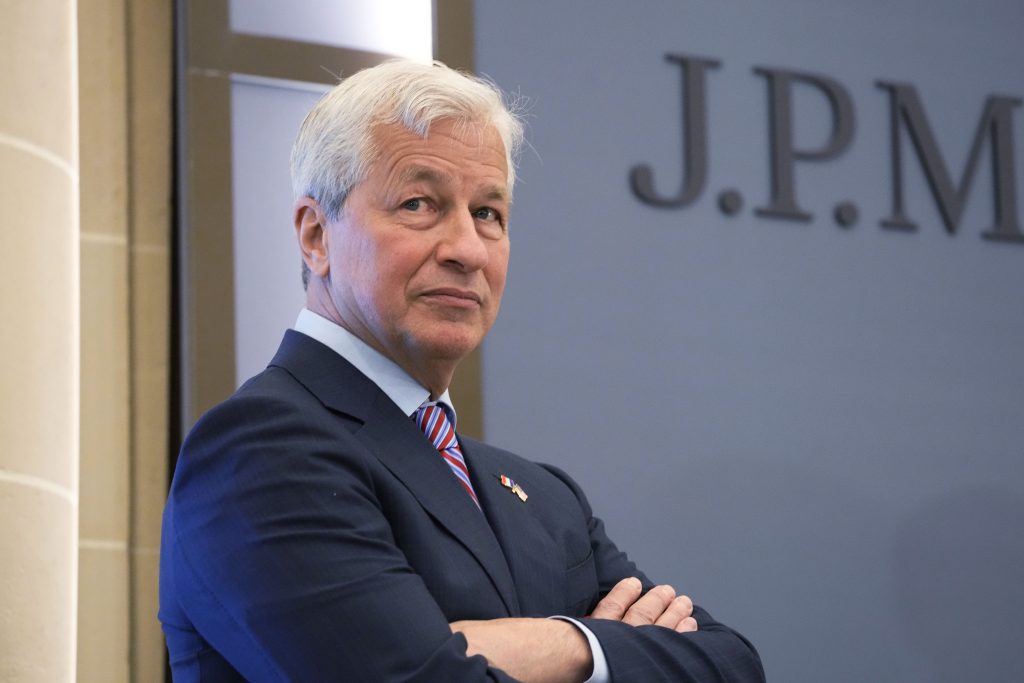

JPMorgan Chase CEO Jamie Dimon Warns America That It Faces Something Worse Than A Recession

JPMorgan Chase CEO Jamie Dimon has warned that the US economy faces a greater threat than a recession. America’s most powerful banker has warned that the threat of stagflation could still strike the US economy.

Stagflation is the combination of economic stagnation and inflation. Prices continue to soar at the same time as unemployment rises and economic growth slows. This creates a multitude of major problems for the US economy.

How Stagnation Is Worse Than Recession

Economists consider stagflation to be worse than a recession. If you are old enough to remember the economic conditions in the US during the late 1970s and early 1980s, then you familiar with stagnation.

Stagnation would send stocks plummeting. Thus, hitting 401(K)s and other retirement savings.

In contrast, during a recession, unemployment increases and the economy shrinks. However, in a recession there is little or no inflation.

Dimon told the media, that the US needs to be prepared for something like that.

He said:

Dimon also stated that the chances of stagflation returning are probably twice that of what others have projected.

JPMorgan Chase CEO Jamie Dimon: How The Markets Are Reacting To Trump’s Tariff Threats

The JPMorgan Chase CEO also said that markets were showing an ‘extraordinary amount of complacency’ in the face of the economic threats of Trump’s tariffs.

Dimon said the full effect of Trump’s aggressive trade policies have yet to be felt.

Dimon is not alone, with a host of major economists also warning that stagflation could return.

‘Directionally, it is stagflation,’ Mark Zandi, chief economist at Moody’s Analytics, warned back in March.

‘It’s higher inflation and weaker economic growth that is the result of policy – tariff policy and immigration policy.’

This is not the first time Dimon has warned that the US economy is in peril in recent months.

Last month the banker predicted that the economy was likely headed towards a recession.

‘Whether or not the menu of tariffs causes a recession remains in question, but it will slow down growth,’ Dimon told investors.

Dimon has run JPMorgan Chase, the largest US bank, for 19 years and is one of the most prominent voices in corporate America.

The bank, which has prominent retail as well as investment arms, has become the world’s biggest and most powerful bank with $4 trillion in assets under Dimon.

The banker has a net worth of $2.5 billion, according to Forbes.

Read More About Trump And The US Economy At MFI-Miami.com