FHA Did Not Approve 40-Year Loans For New Home Buyers. The New Rule Only Applies To Modifications Of Existing Loans

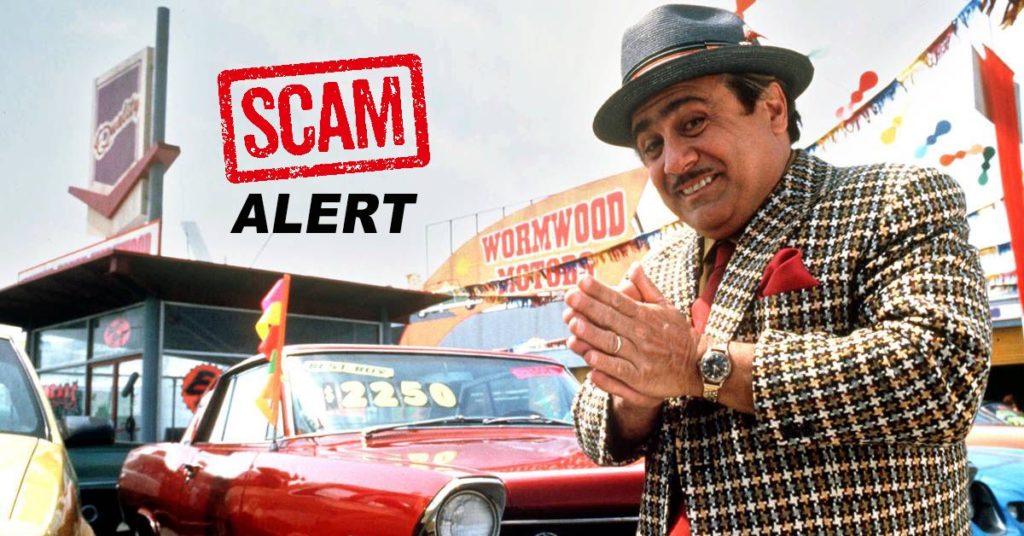

Greedy mortgage brokers are spreading misinformation on TikTok. This time its about recent a FHA announcement. The FHA announcement regards the increase the mortgage modification term to 40 years. Tik Tok creators are posting videos stating that FHA created a 40-year loan program for first time homeowners. Let’s make it clear! FHA did not approve 40-year loans for new applicants.

The FHA announced a final rule last month that allows mortgagees to increase the maximum FHA-insured mortgage loan modification term from 360 months to 480 months. However, that only applies to loans in default. following a default. FHA said the change is slated to go into effect on May 8.

TikTok content creators have been posting videos claiming FHA approved a 40-year mortgage loan program for first-time home buyers.

The new FHA regulation is only a loss mitigation option. It is geared toward helping homeowners retain their homes after defaulting by giving them a lower monthly payment.

The 40-year loan modification can also assist borrowers in avoiding foreclosure by spreading the outstanding mortgage balance out over a longer period.

One TikTok user who claims to be a financial advisor plays the role of a HUD advisor (which is highly illegal) states:

Right now, a 30-year FHA loan for $500,000 at 6.7% interest would cost $3,500 a month. What if we allowed a 40 year option that would only be $3280 a month saving them $220?

The FHA’s final rule also aligns with modifications available for Fannie Mae and Freddie Mac-backed loans.

Borrowers would see additional interest payments over the course of the extended term. However, HUD also noted that the opportunity for borrowers to retain their homes with a lower payment outweighs the drawbacks.

Read More About FHA Loans On MFI-Miami