UWM Announces Major Expansion Of Its Popular Bank Statement Loan Programs.

Pontiac, Michigan based lender UWM Announced Wednesday that it intends on expanding its bank statement loan program. The plan is to provide additional flexibility and opportunities for independent mortgage brokers and self-employed borrowers.

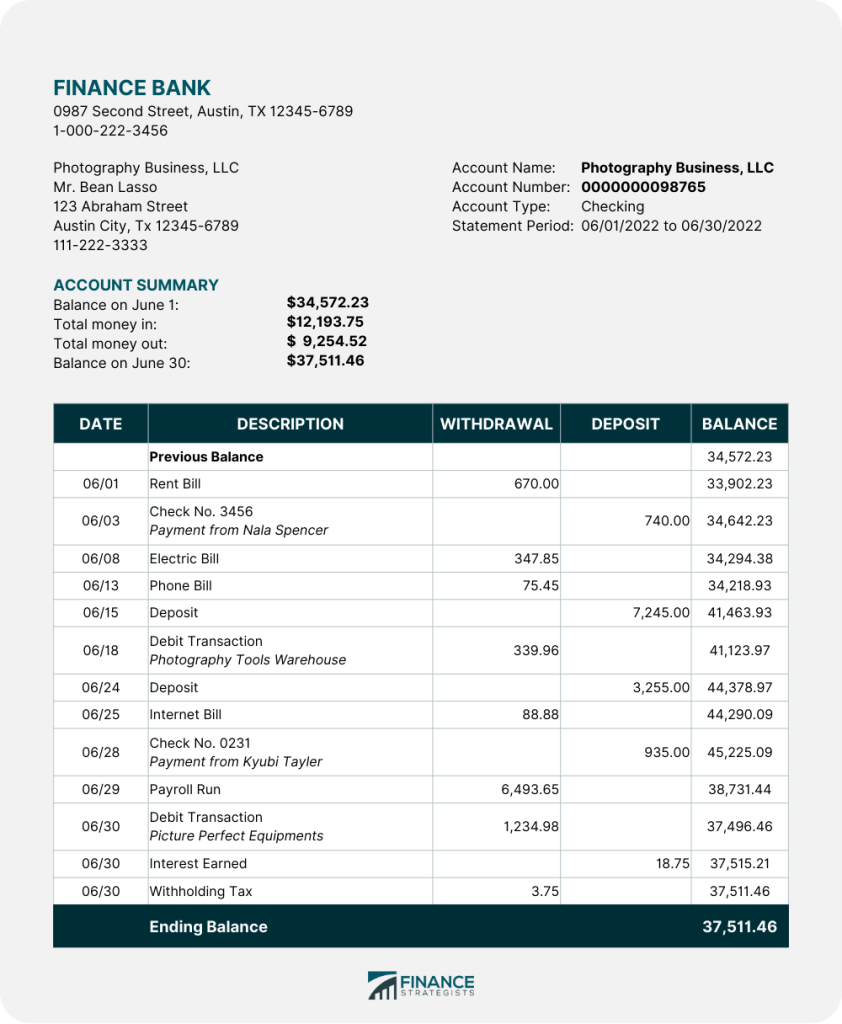

The UWM program will allow borrowers to use their bank statements as proof of income. However, the program is considered a non-qualified (Non-QM) mortgage. A Non-QM loan is essentially a non-prime loan. Therefore, it is not required to meet GSE-standard documentation requirements.

Industry insiders also consider these types of loans riskier than conforming loans. They believe they pose a greater risk for default and possibly foreclosure. Why? Simply put, they are not backed by Fannie Mae or Freddie Mac. Additionally, these loans come with higher interest rates. Thus, may make some investors on the secondary market nervous.