How Bank Bean Counters Are Skirting The National Mortgage Settlement And Forcing Homeowners To Face A Bigger Nightmare

Last summer, I wrote about how Bank of America was selling off it’s mortgage serving portfolio to companies like servicers like Greentree, Nationstar and Seterus who are not regulated by the Office of the Comptroller of the Currency in order to circumvent the commitments they made to the National Mortgage Settlement.

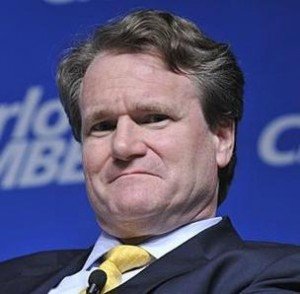

That decision by Bank of America CEO Brian Moynihan, Ron Sturzenegger, the executive in charge of Bank of America’s Legacy Asset Servicing Division and Tony Meola, Bank of America’s Executive of Fulfillment Operations nearly a year and half ago is now creating a crisis of zombie foreclosures in Florida.

A perfect example of this is Karl and Vicktoria Hanson in Plant City, Florida. Due to the financial crisis, Karl Hanson lost his job and like everyone else facing a job loss, the Hansons soon faced Bank of America initiating a foreclosure action against them. Unable to make the payments and without the ability to fight the foreclosure with Bank of America, the Hansons walked away from the home they raised their children in soon after being served with a foreclosure lawsuit.

For the past several years later, the Hansons have for the most part rebuilt their lives and overcame the psychological trauma caused by the financial crisis. The only piece missing to making their life normal again was home ownership.

Earlier this year, they applied for a new mortgage and discovered their home that they believed was long sold off in a foreclosure sale was in fact still owned by them and Green Tree Servicing was reporting the mortgage as being default but was also showing the account as still being open.

Last year, while the Hansons were in foreclosure with Bank of America, Meola, Moynihan decided Sturzenegger made the decision to take Bank of America out of the mortgage servicing industry and sold the servicing rights to the Hanson’s home to Green Tree Servicing, a non-signatory to the National Mortgage Settlement.

Because Bank of America withdrew from servicing the Hanson’s loan, it also meant that the foreclosure process initiated by Bank of America also was stopped.

This means the Hansons still own their old house and are still responsible for the mortgage, late fees and attorney fees on the mortgage.

Brent Lindahl, of Green Tree Servicing LLC told WFLA, “The mix-up was due to confusion during the transfer from Bank of America. He said Green Tree does not intentionally drag its feet on foreclosure actions.”

To Green Tree to their credit also agreed not to pursue a deficiency judgment. According to WFLA, Lindahl said, “Green Tree is willing to work out a deal with the Hansons to either foreclose quickly or short sale the property…the lender will not require the couple to pay a deficiency judgment.”

After learning they still owned the property, the Hansons went to visit the their old house covered in graffiti, they found scrappers had stolen the air conditioning unit, the copper wiring out of the walls and anything else that could be sold for scrap had been ripped from the house.

Now the trashed and gutted home that was once filled with the laughter of children is not only worth much less and much harder to sell but may turn out to be a bigger nightmare for the Hansons. Because the Hansons are the legal owners and were the legal owners while it sat vacant, they are liable for any acts that occurred on the property while the property sat vacant and may occur until the ownership of the property is transferred to someone else.

After discovering they still own the property, the Hansons hired attorney Stephen Hachey who told WFLA, the same thing MFI-Miami tells all of our clients, “The bottom line here is that a foreclosure isn’t over until a judge says it is. Homeowners shouldn’t abandoned homes until they are sure they no longer own them.”

Write A Comment