John Cusack Is Peddling A Plan That Takes Money From Pension Funds And Gives It To His Millionaire Buddies

Actor John Cusack should stick to acting. He’s no financial genius. He is peddling a scheme that would take money from grandma’s pension and give it to his millionaire pals. The only problem is that is illegal. Let me explain.

In June, I received a call from the Lois Lane of financial journalism, Teri Buhl. She asked me if I knew anything about San Bernadino County wanting to use eminent domain as a way to resuscitate the housing market.

I figured if it was like 99% of the other schemes out there. She advised me I better start paying attention to it. This was big and the company behind it was pitching it to other cities plagued by foreclosures.

There’s a lesson in this for you wannabes out there. If Teri Buhl calls you asking you questions, you better have your homework done. If you don’t, you better hurry up and cram. A call from Teri Buhl is usually a first warning something big is going to happen in the next 60-90 days.

Eminent Domain: The The San Bernadino Treat?

San Bernadino wants to use it’s authority as a government entity to use eminent domain as a way to acquire a homeowner’s mortgages. They want to modify them then re-bundle them into pools and sell them to a private hedge fund to Mortgage Resolution Partners. This plan is controversial and potentially illegal. There are multiple controversies with this. Tthe most important being that eminent domain is generally used for properties, not securitized debt obligations.

Teri Buhl covered the public hearing about this in San Bernadino and wrote about it on her site the next day. She also appeared on the Keiser Report.

Teri Buhl and Max Keiser point out eminent domain not designed for a scheme like this. It is a government forced redistribution of wealth from one private investor to another.

The loans that would be put in eminent domain are not non-performing mortgages or abandoned homes. They are loans are performing. These loans could conceivably be sold to FHA or another government entity.

Thus, making hugely profitable for the fund managers. The big losers are investors on both sides of this. The biggest hit being taken by investors who have money tied directly or indirectly to mortgage-backed securities. Current MBS investors take a 20% hit of their investment. Investors in mortgage-backed securities are usually pension funds and retirement funds.

Felix Salmon Agrees With Buhl and Keiser

Felix Salmon also affirmed what Buhl and Keiser stated in his piece in Reuters on July 9th. He writes:

Mortgage Resolution Partners Recruits John Cusack

Mortgage Resolution Partners, the fund pitching this to local governments, must have seen Keiser’s show and read the articles by Teri Buhl and Felix Salmon. MRP stepped up their public relations efforts. They brought in actor John Cusack to pitch it for them.

When the Huffington Post launched their new HuffPost Live video segments, they discussed MRP’s eminent domain scheme. The roundtable featured Arianna Huffington, the Chief Strategy Officer of Mortgage Resolution Partners, John Vlahoplus and his pal, actor John Cusack.

What the hell is John Cusack doing on this panel?

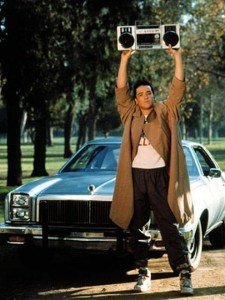

John Cusack looked like he had just rolled out of bed. Besides John Cusack is an actor. He is not a finance guy. You soon learn that John Cusack is friends with both Arianna Huffington and John Vlahoplus. He claims to feel passionate about what MRP is proposing.

John Cusack and Vlahoplus make it sound like their plan is for distressed or abandoned homes. This is not true. It is for non-distressed performing mortgages.

Second, John Cusack and Vlahoplus gloss over the legality of such a scheme. As Buhl, Keiser, and Salmon pointed out, this scheme could be ruled unconstitutional by the federal courts. As Felix Salmon puts it:

Is John Cusack A Paid Pitch Man Or What?

Call me a cynic. I’m not buying John Cusack’s claim that he’s doing this as an activist. I also don’t believe he’s doing this to help his buddy John Vlahoplus.

I also find his plea that “something is better than nothing” is reckless and irresponsible. Now we have bored celebrities sticking their nose into the fray acting like experts.

I have had high profile clients in the entertainment industry. As a result, I can tell you that they don’t volunteer for a cause unless it will raise their profile. They are also willing to whore themselves out for a paycheck. Is John Cusack getting paid as a spokesperson by MRP? I have no problem if he is. Plenty of celebrities have promoted companies in the areas of finance. John Houseman did it for Smith Barney back in the 1970s. Robert Wagner and Henry Winkler have even peddled Reverse Mortgages. I do have a problem with John Cusack. He is promoting this eminent domain scheme is if he is being paid and is not disclosing it.

This eminent domain plan would be a great idea if MRP were proposing it on distressed or abandoned properties but they’re not. On the contrary, it is not. It would be different if the investors of the affected MBS Trust had already cashed in their insurance policy. The problem with this is that Trustees and servicers guard this information as if were the launch codes for America’s nuclear arsenal.

Write A Comment