Contrary To What The Prosecutor May Allege, You Committed Mortgage Fraud, Doesn’t Mean You’re Guilty.

Clients accused of mortgage fraud tell MFI-Miami they didn’t know they were committing a crime.

In most cases, mortgage fraud suspects are usually right. The fraud is in the imagination of the prosecutor or U.S. Attorney with political ambitions. Most prosecutors have Kardashian Syndrome. In most cases, prosecutors tend to target amateur real estate investors and homeowners they know can’t afford high-end lawyers. Prosecutors figure they can get a quick conviction and fine from the individual. They can also get their name on the news.

Federal and state prosecutors tend to prefer going after these types of individuals because it’s a numbers game. Prosecutors can extract fines from 10 homeowners or amateur investors faster and more cheaply than one deep pocketed bank executive.

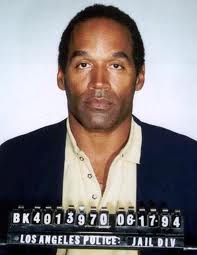

Prosecutors often have to decide is it wiser to spend tens of millions of dollars attempting to conviction billionaire bankers with deep pockets and run the risk of being publicly humiliated or do they spend $25,000 to $50,000 pursuing the one homeowner with no money who overstated his income on his mortgage or a short sale application and squeeze a $100,000 fine out of him? I call this the OJ Simpson Litmus Test.

OJ Simpson Litmus Test

People don’t realize that while OJ Simpson was on trial for murdering his wife, there was another trial going on in the courtroom next door. Another black man was accused of murdering two people.

This black man had a public defender for a lawyer and Simpson had the million-dollar legal dream.

Simpson spent the next 13 years playing golf and picking up bar hoes in the Miami suburbs. The guy in the courtroom next door went to San Quentin. This unknown man spends every day clutching a bar of soap in the prison shower hoping not to drop it.

The Simpson acquittal was an embarrassment for a lot of people. It almost cost former LA District Attorney, Gil Garcetti his re-election in 1996. Prosecutors then stopped pursuing wealthy suspects after that.

Now Enter The Complex World of Bank and Real Estate Fraud

Mortgage fraud is often a complex crime that can involve both mortgage brokers, lenders and borrowers. It occurs when someone lies, intentionally confuses, or intentionally omits important information.

An allegation of mortgage fraud is possible through only a single act of “misrepresentation.” either a lender or a borrower.

Mortgage Fraud Involves Intent, Not Mistakes

Mortgage fraud is only a crime when someone knowingly makes misrepresentations or omissions in order to benefit from a transaction. It can also only exist as long as the intent to defraud is present. Prosecutors will often try to allege intent even if it is obvious there was no intent. They do it to coerce a cash settlement from the defendant.

If a borrower who mistakenly reports income information for a modification or short sale does not necessarily commit mortgage fraud. Put another way, mortgage fraud exists as long as the intent to defraud is present.

For example, an appraiser who intentionally misrepresents a home’s value in hopes to later get the buyer to sell commits mortgage fraud. It doesn’t matter if the seller never agrees to the scheme or the appraiser never makes a profit. The appraiser knowingly made a material misstatement of the facts in the mortgage application process.

Professional Fraud

Lenders and Real Estate Agents can also commit a type of mortgage fraud at expense of the borrower. This type of mortgage fraud is sometimes known as “fraud for profit” or professional mortgage fraud.

Professional mortgage fraud often involves complicated schemes and collaborations by multiple parties. Parties usually include mortgage brokers and real estate agents. More elaborate schemes involve accountant and investment bankers. The purpose of these schemes is to make money off an unsuspecting homeowner.

Federal Prosecutions

In addition to state mortgage fraud crimes, federal prosecutors can also prosecute individuals or organizations for mortgage fraud. Federal criminal laws often apply when the activity involved crosses state lines. The federal government will also get involved if the lender is chartered by the federal government.

The federal government also has jurisdiction with loans insured by FHA, Fannie Mae or Freddie Mac. Up until recently, federal prosecutions for mortgage fraud usually targeted professional fraud. However, the federal government has increased its pursuit of homeowners and real estate investors. Prosecutors will allege fraud even when its obvious intent is or was never present.

Fraud and Organized Crime

In some situations, federal prosecutors have filed RICO charges against large-scale mortgage fraud operations. RICO stands for the Racketeer Influenced and Corrupt Organizations Act. Federal prosecutors typically use RICO charges against organized crime organizations such as mafia groups or gangs. Federal prosecutors have increased the use of RICO charges in mortgage fraud cases after the financial crisis began in 2007-2008.

Penalties

Mortgage fraud allegations should be taken seriously. Even if it is obvious that there was no intent by the alleged suspect to commit fraud. State and federal prosecutors will pursue a suspect even if they feel they can’t get a conviction in order to coerce a cash settlement.

Mortgage fraud can involve different crimes at different levels. Therefore, the potential penalties associated with the crime differ widely.

Prison

Prison penalties for mortgage fraud can be significant and contrary to popular belief, most people who get convicted of mortgage fraud you don’t get sent to a minimum security prison with tennis courts like Jordon Belfort or Michael Milken. Unless you are wealthy or a politician, most people convicted of mortgage fraud get locked up with the drug dealers and hardened criminals in federal prison like in the old HBO series, Oz for up to 30 years. State convictions can be just as long as 25 years. Misdemeanor fraud convictions can bring jail sentences of up to a year

Fines

Fines for mortgage fraud are often extremely high. A conviction for a single count of a federal mortgage fraud can result in a $1 million fine. State fines can range from a few thousand dollars for a misdemeanor conviction to $100,000 or more for felony convictions.

Restitution

Mortgage fraud convictions often include restitution payments as well. Restitution is different than a fine, though they both involve money.

Probation

Probation sentences for mortgage fraud typically last at least one to three years. Someone on probation must meet specified court requirements. They must make regular reports to a probation officer and submit to random drug testing.

Find a Lawyer Immediately

If you learn you are being investigated for mortgage fraud you need to contact a criminal defense attorney immediately. You need a lawyer that specializes in white collar crime. If you need help finding one, MFI-Miami will help you find one.

Your ability to keep yourself out of prison depends on your ability to stay calm, know your rights, and listen to the advice of an experienced criminal defense attorney. An experienced criminal defense attorney will guide you through every stage of the criminal justice process.

Write A Comment